- TechTO

- Posts

- October 12, 2023: How much time will this save you?

October 12, 2023: How much time will this save you?

Make month-end a breeze, position yourself for success, lessons from Inkbox's CEO and meet the companies hiring this fall

Profile: Making month-end a breeze with Float

Float Co-Founders (image c/o BetaKit)

What is Float?

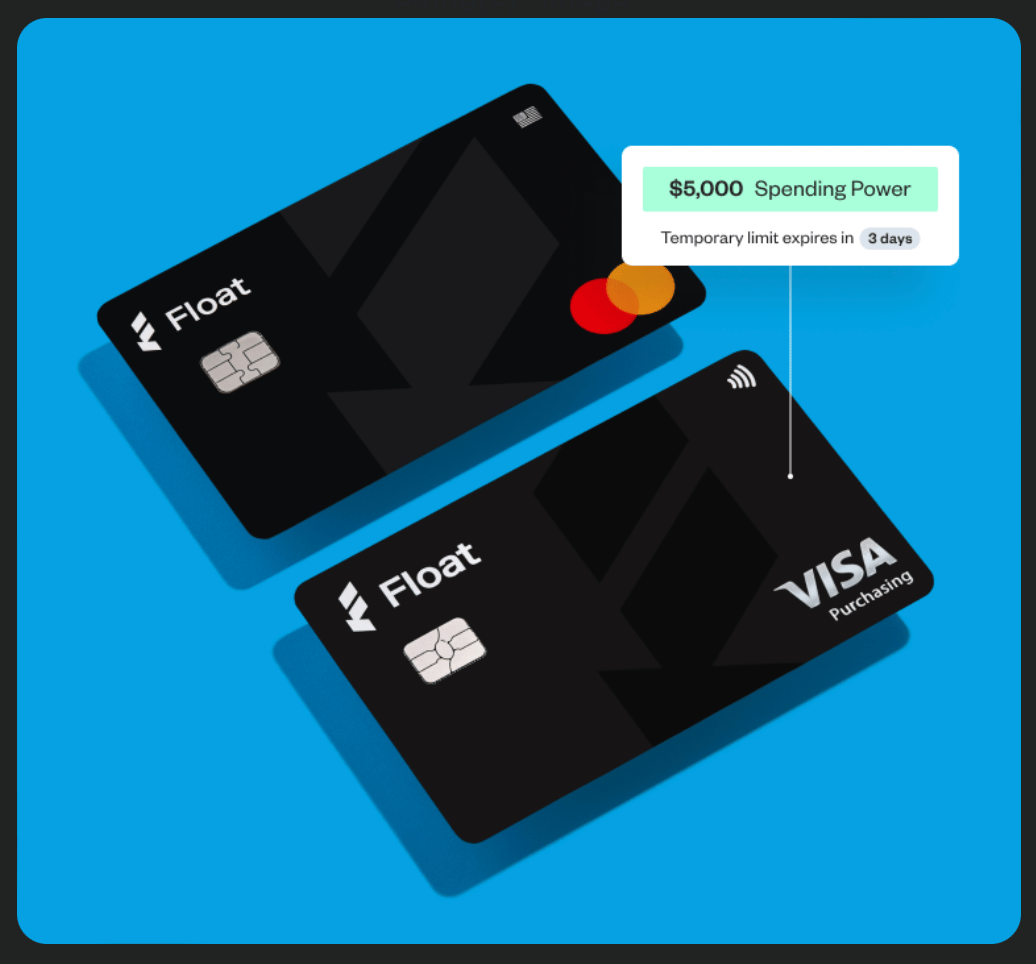

Float simplifies spend for companies and teams with their corporate cards and spend management platform.

What was the insight/inspiration that led you to launch it?

Ruslan (one of the Co-Founders) shared that the inspiration came from personal experiences incurring expenses on behalf of his employer, then having to go through the expense reporting and reimbursement process at the end of each month.

It was time consuming and not cost-effective for teams.

How has Float been received by the market?

The past two years have seen organizations of all sizes making significant changes to the way they operate, with the COVID-19 pandemic necessitating the closure of offices and driving a widespread shift to remote work. Khazzam (CEO) says that this new paradigm brought with it further spend-management challenges, as businesses must now deal with work-from-home stipends, ongoing expenses like internet for home offices, and virtual team events that require employees to buy their own meals.

“Our customers are using Float to issue physical and virtual cards for employees and manage their recurring or one-time expenses through our software,” Khazzam says.

“Now, if someone needs to travel or purchase supplies for a company social, they can simply get a top-up on their Float card, text a copy of their receipt, and that’s it. No back and forth, and no waiting to file an expense report.”

How is Float helping?

Float’s solution helped ease a major pain point for Vancouver-based scaleup Klue, a market-intelligence platform.

With over 150 employees, Klue’s finance team found itself spending untold hours tracking down and matching receipts, filing expense reports, and processing payments.

With Float, Klue’s employees can now make purchases with a virtual corporate card and upload receipts via Slack. Based on individual employees’ role or use case, the finance team can set different spend limits, with real-time visibility into each transaction.

As Klue continues to grow, new employees can be set up with a card in seconds, dramatically reducing the time from onboarding to up-and-running.

How has Float focused on growth?

Float is growing rapidly in its own right, having expanded its customer base over the past year to more than 1,000 Canadian businesses across diverse industries, including online auto marketplace Clutch, HR service Humi, real-estate startup Properly, and crypto exchange Coinberry.

The keys to Float’s success, have been its hyper-focus on the Canadian market, and its ambition to be recognized as the country’s biggest homegrown solution to corporate spending.

#ICYMI - At last night’s TechTO: Premium LIVE from Rotman, we had the chance to sit down with Co-Founder Ruslan Nikolaev and discuss:

Staying ahead in the fiercely competitive FinTech space

How Float has continued to evolve beyond corporate cards

Marketing Float and building on the rapid growth

Partner Content: Volley

Case Study: A Canadian B2B startup with 2 sales reps was launching 1,000s of templated email campaigns to potential customers monthly. This process led to poor deliverability, low response rates, and a lot of annoyed responses from prospects.

Personalizing every email simply wasn’t realistic. It was a time-consuming bottleneck, taking 5-10 minutes per contact when done right. With Volley, it’s possible to have high outreach volume without sacrificing high-quality research and personalization.

The Volley platform gives you:

Relevant & personalized messages for every contact

Unique research sources: online reviews, open jobs, social media posts, recent news, etc...

Integration with email sequencing tools (e.g., Instantly.ai).

1:1 support from our Lead Generation Experts

Special offer for the TechTO community: Get an additional 2,000 contacts with any of our product plans!

Book a call here!

*this is sponsored content

Quick Take: Founders, funding and resilience in the tech world

image courtesy of ideogram.ai

What has the last month shown us about the future of raising capital and surviving?

Over the last month (or so), we've witnessed a convergence of common themes - the power of experience, adaptability, and leveraging cutting-edge technology in securing funding and achieving resilience.

Here's a closer look at the key takeaways from these stories and how we can use them to position ourselves for success in the ever changing tech sector:

1. Leveraging Expertise for Funding Success:

Two seasoned founders, Dennis Pilarinos and Amar Varma, made headlines by announcing their new ventures and securing substantial funding. Their experience, gained from previous successful exits and ventures, played a pivotal role in their funding success.

Dennis Pilarinos introduced "Unblocked," a developer tool addressing codebase challenges. Pilarinos's background in scaling and exiting buddybuild equipped him with the credibility to tackle this problem.

Amar Varma introduced "Ten Key Labs / Mantle," designed to streamline equity management. Varma's experience as a venture capitalist and active angel investor positioned him to solve this problem.

The common thread: Experience, especially in areas where founders have credibility, can significantly impact the ability to secure funding.

2. The Rise of Large Language Models (LLMs):

Both ventures are leveraging the power of Large Language Models (LLMs), a growing trend among experienced founders. LLMs are being incorporated into innovative solutions, indicating that tech founders are exploring how these models can enhance product development and problem-solving.

3. Clearco's Resilience Case Study:

Clearco's recapitalization, reducing its valuation from over $2 billion to $200 million, demonstrates the ever-changing dynamics of tech startups and investor sentiment.

Key factors in Clearco's resilience include the support of existing investors, adaptability to market changes, and the importance of strong investor relationships.

4. Streamlining VC Due Diligence:

For tech founders seeking venture capital, a smooth due diligence process is crucial. Founder-initiated steps like engaging a credible client, preparing the client, and facilitating reference calls can enhance the process and build trust with investors.

The goal is not only to secure funding but also to establish a long-term relationship with investors.

What is the common theme?

The stories of experienced founders securing funding, Clearco's financial restructuring, and streamlining VC due diligence collectively emphasize the significance of experience, adaptability, and leveraging technology in the world of tech startups.

These lessons underscore the need for founders to not only innovate but also build strong relationships with investors to navigate the ever-evolving tech landscape successfully.

Our takeaway: It is a team effort. Meet the people who support your vision and will support as the environment around you changes.

Reply to this email and let us know your takes, and what you’d like to hear about on a future episode

Reads & Opportunities

This Toronto-based company just secured $100m

The startup helping businesses avoid cyberattacks with AI

16 companies hiring this Fall

This week’s lesson from inkbox CEO, Tyler Handley: Don’t hire an asshole

Do you like our new format? |

Want to showcase your company, events, and opportunities to 60,000+ subscribers across the Canadian Tech Eco-system? Reach out to [email protected] to learn more

Reply